The priorities for corporate travel have shifted. Cvent partnered with Censuswide for the Europe edition of The Cvent Travel Managers Report 2024 to understand this repositioning of 600 corporate travel decision-makers’ process of sourcing venues and business travel.

Are you up for the challenge?

Test your knowledge on the shifting landscape of corporate travel with our quiz based on The Cvent Travel Managers Report 2024.

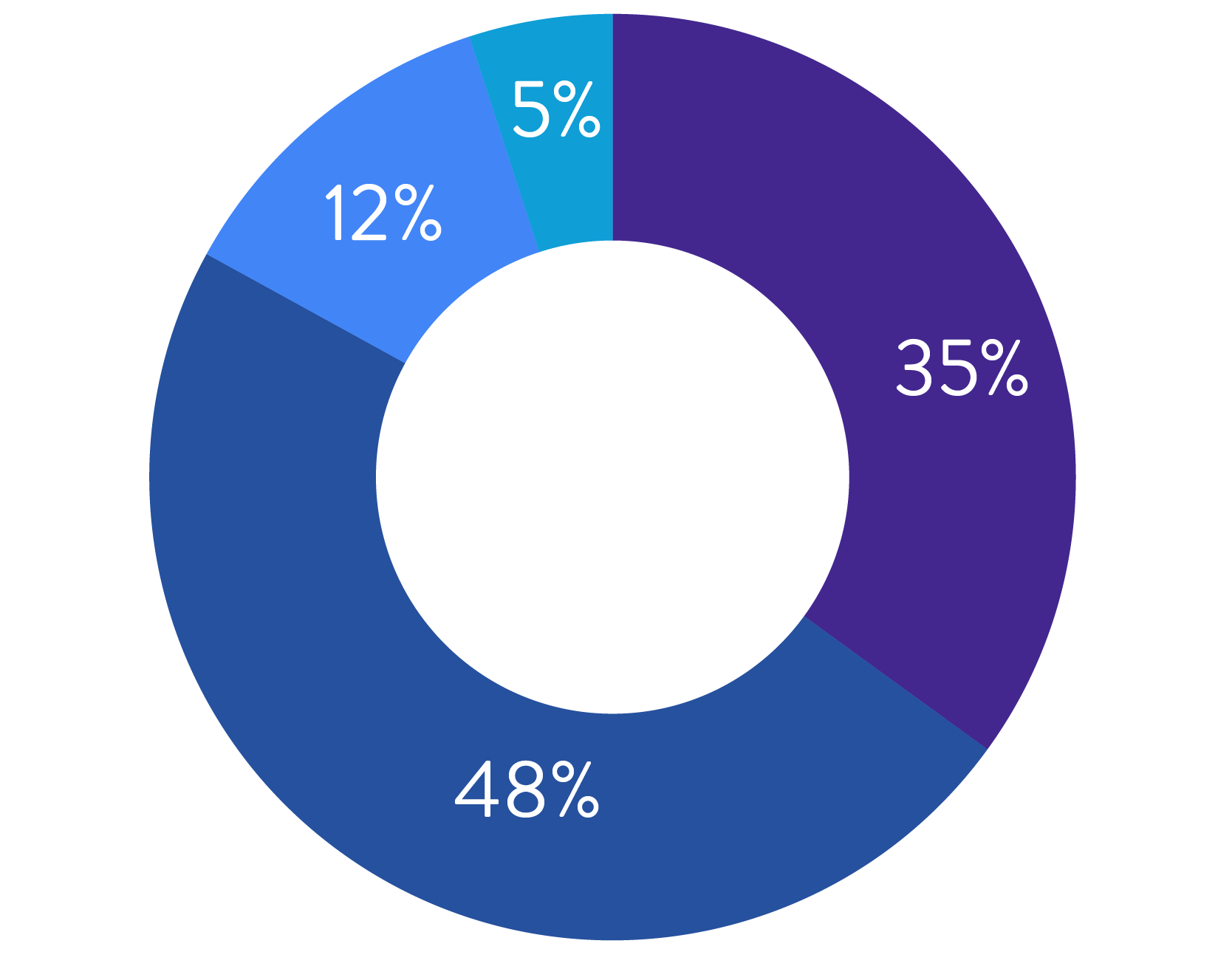

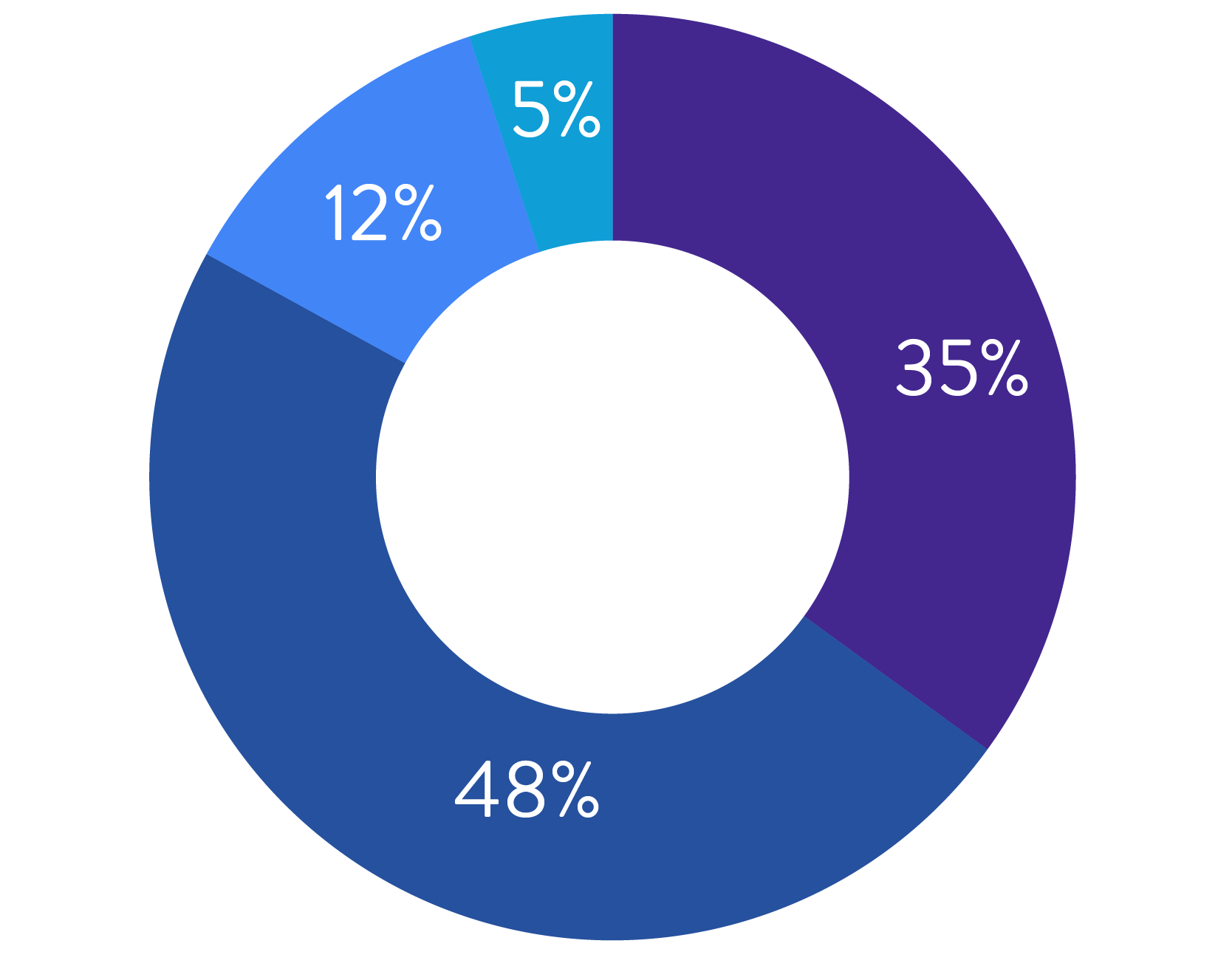

83%

Very Positive

83% of travel managers feel extremely optimistic about the current state of business travel. This is most likely the case for travel managers in Spain (91%) and the Netherlands (91%)

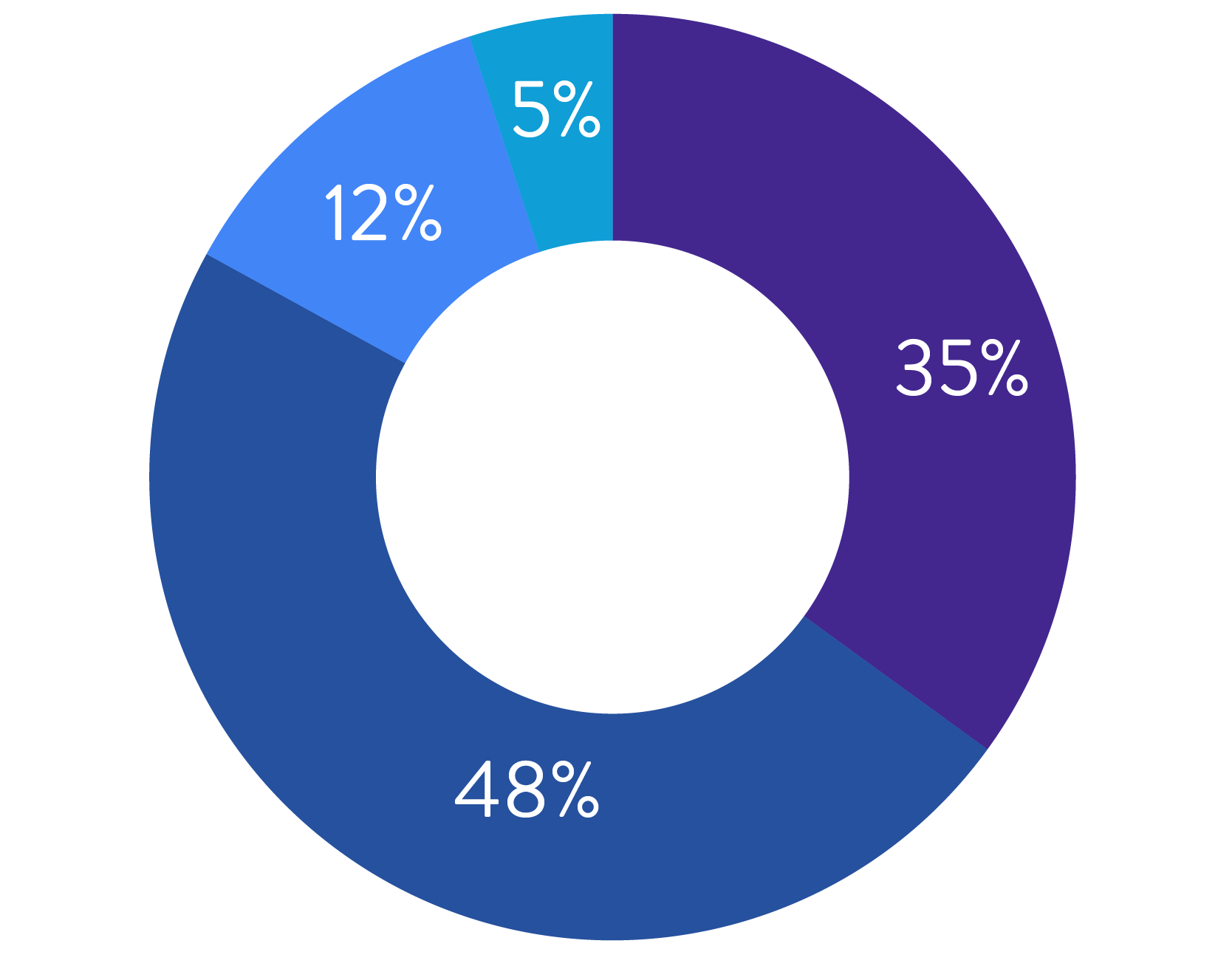

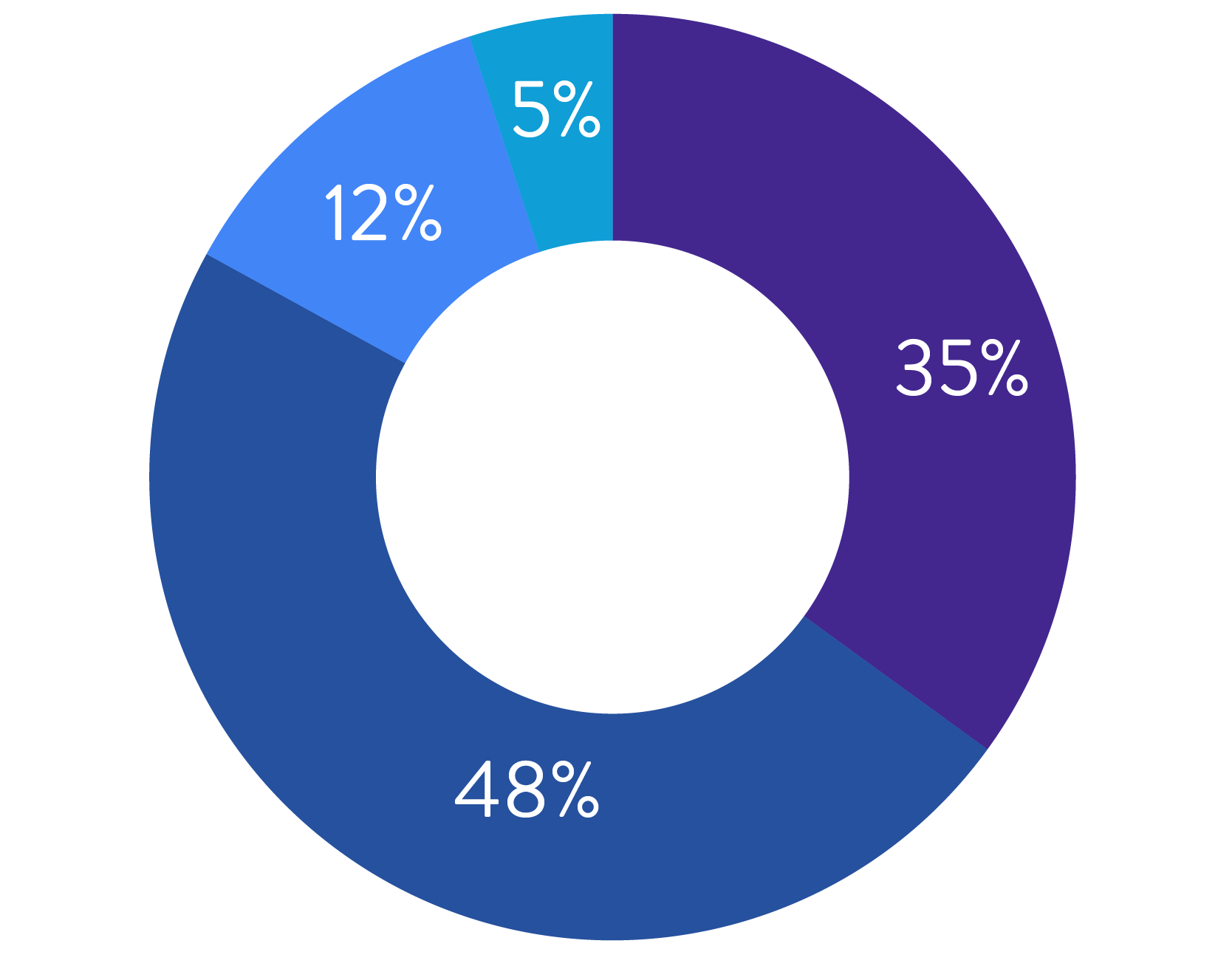

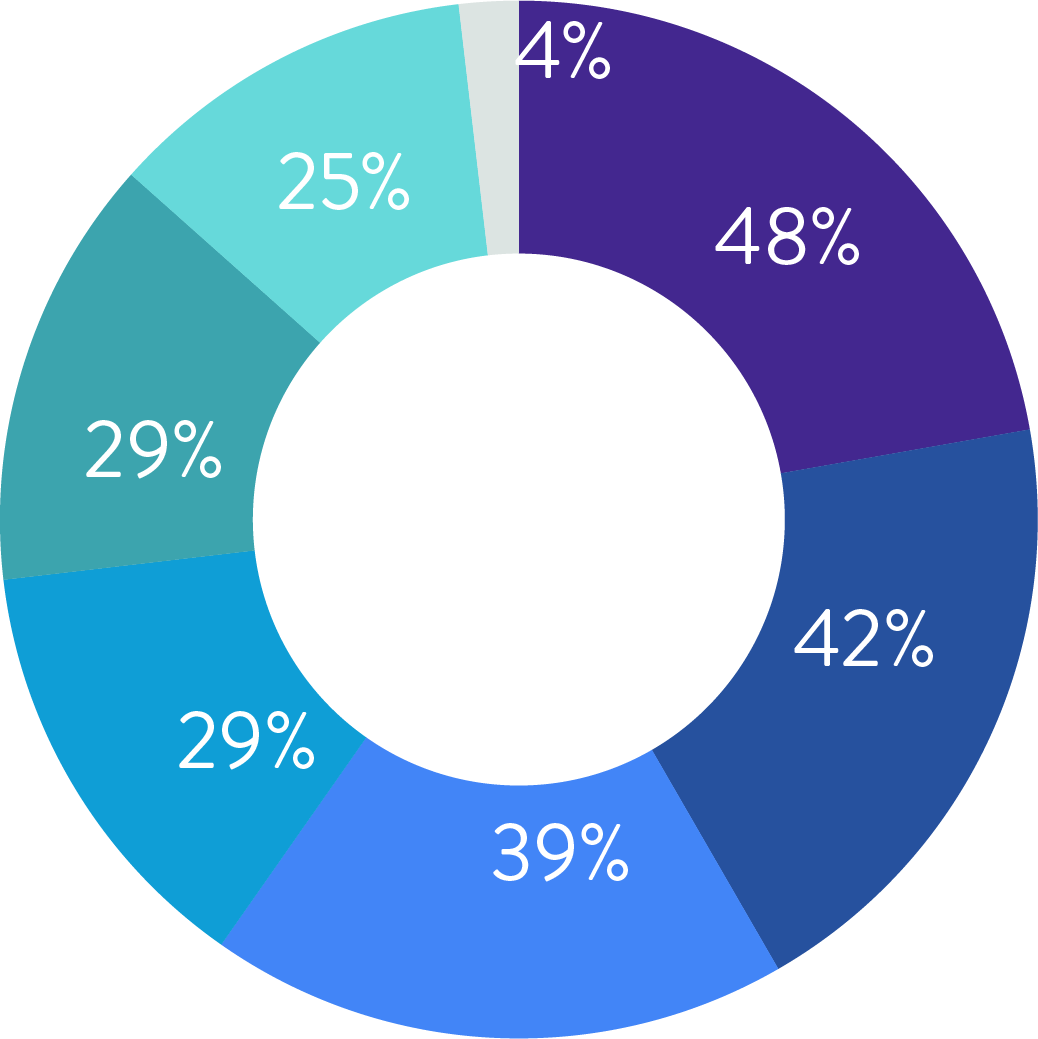

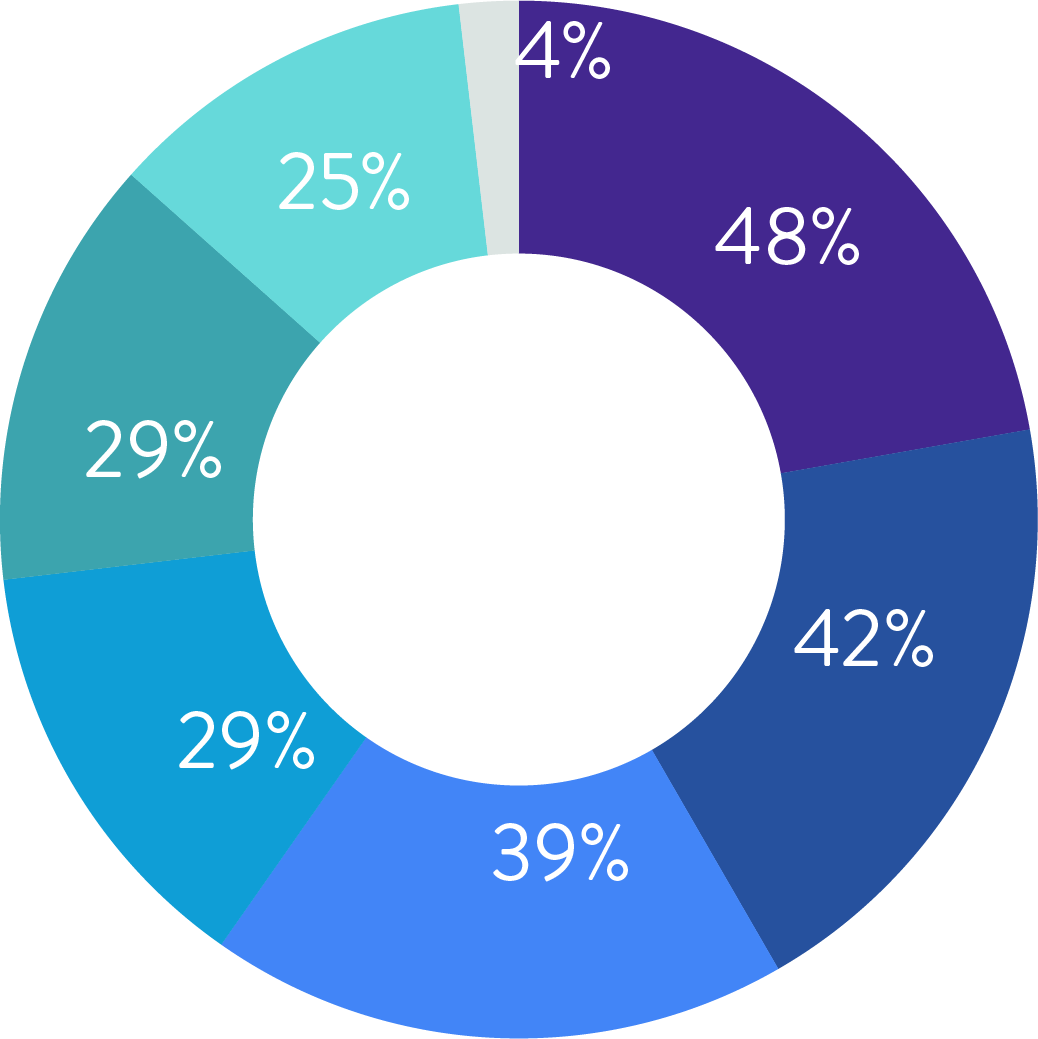

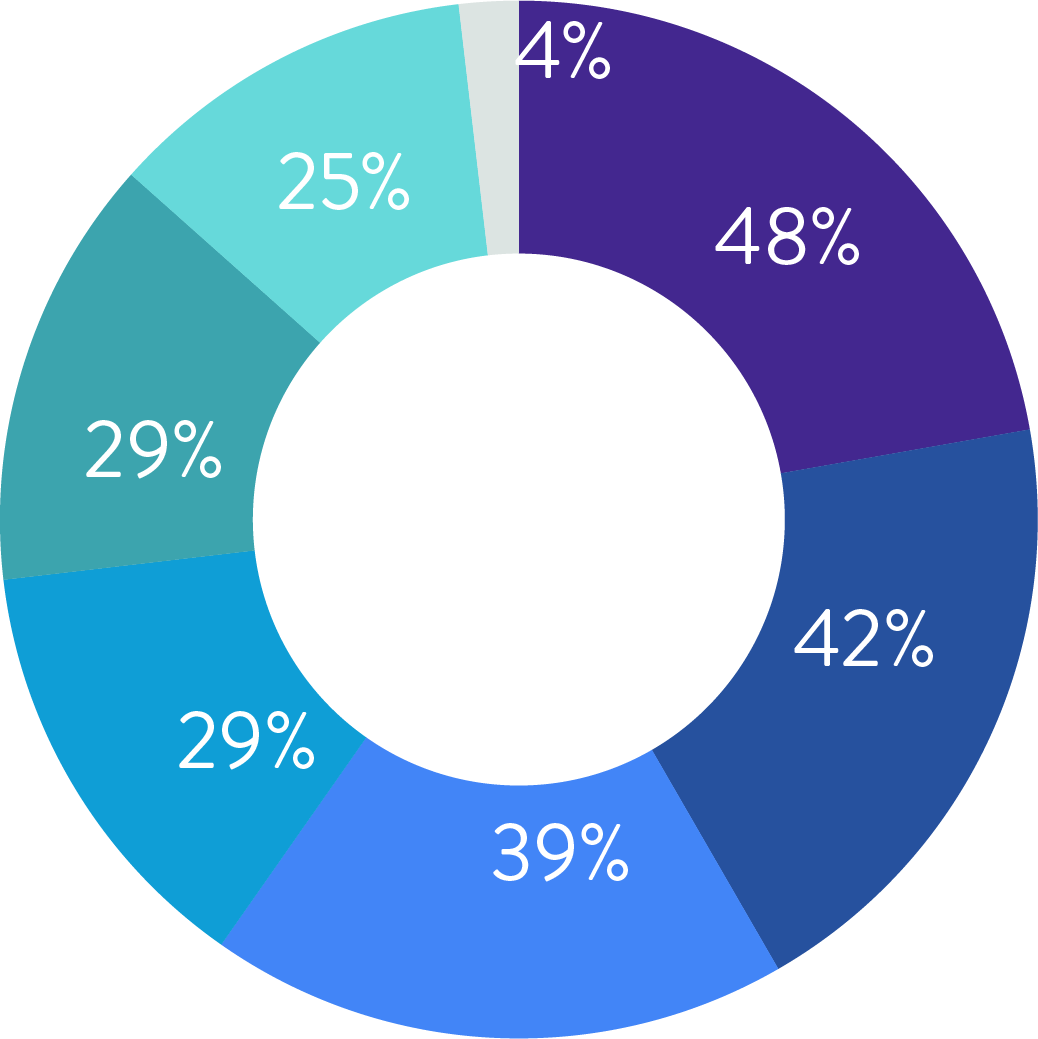

48%

Somewhat Positive

12%

Neither positive nor negative

5%

Somewhat negative

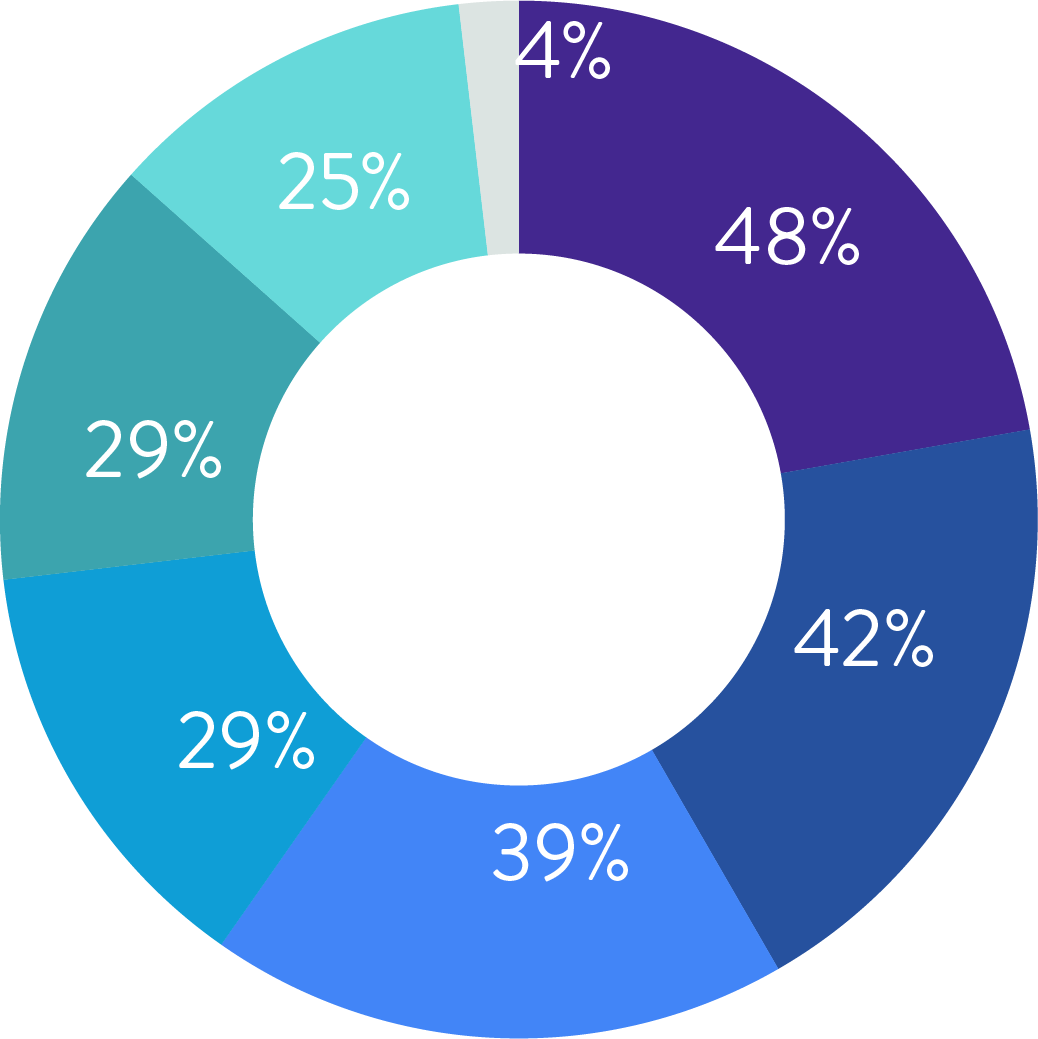

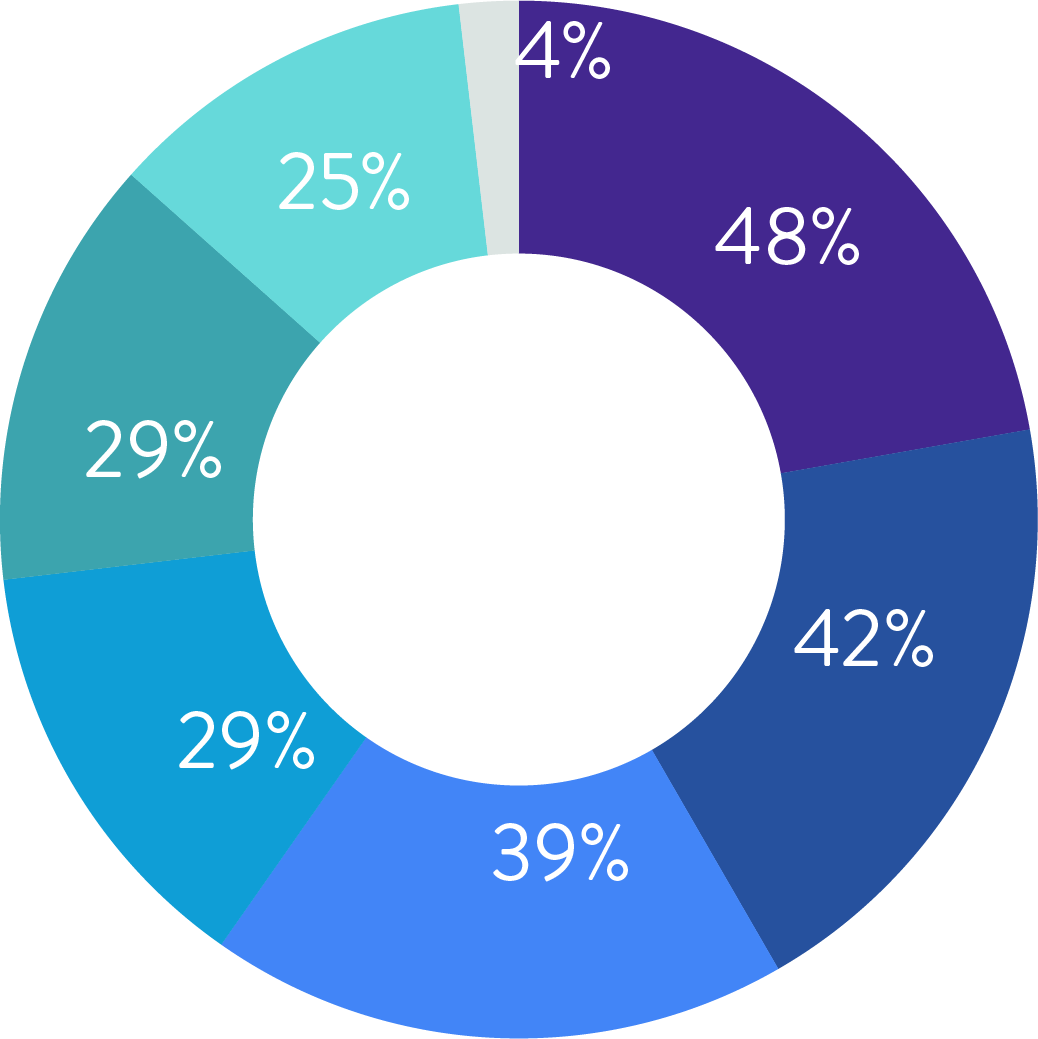

48%

Guest room specifications, images, and video

Majority of the travel managers prioritise the features and comfort of a guest room and consider detailed specifications as an influential factor in their decision to submit an RFP.

42%

Images and video of the hotel and surrounding area

42% of the travel managers value the overall appearance of the hotel and are influenced by the images showcasing the hotel’s ambience.

39%

Peer reviews/ratings and testimonials

Feedback from other travellers, testimonials, peer reviews, and ratings go a long way for 39% of the respondents

29%

Information about sustainability initiatives

29% of travel managers classify environmentally conscious practices and sustainability initiatives to be a critical criterion for submitting an RFP.

4%

None of the above

4% of the travel managers decide whether or not to submit an RFP depending on factors other than listed here

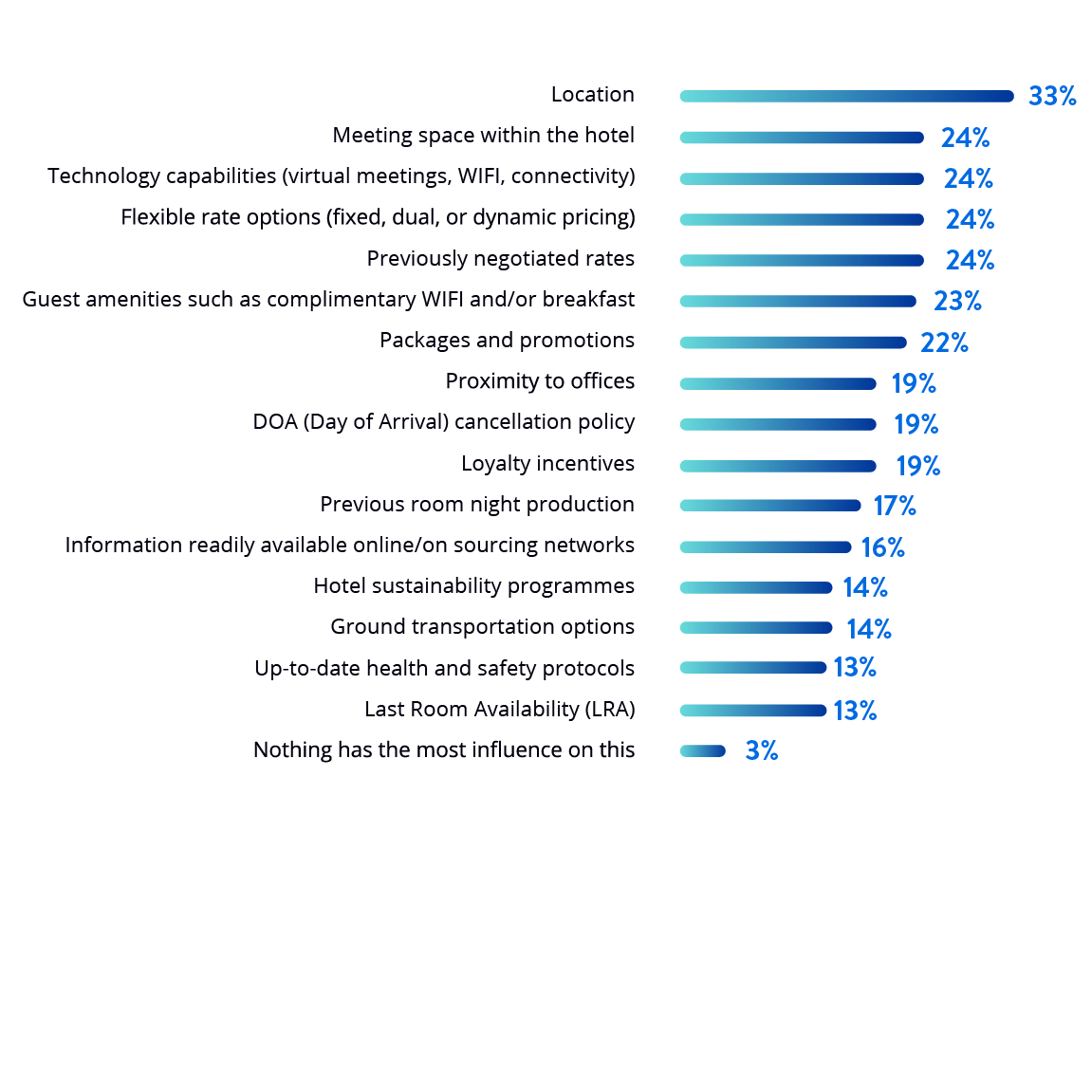

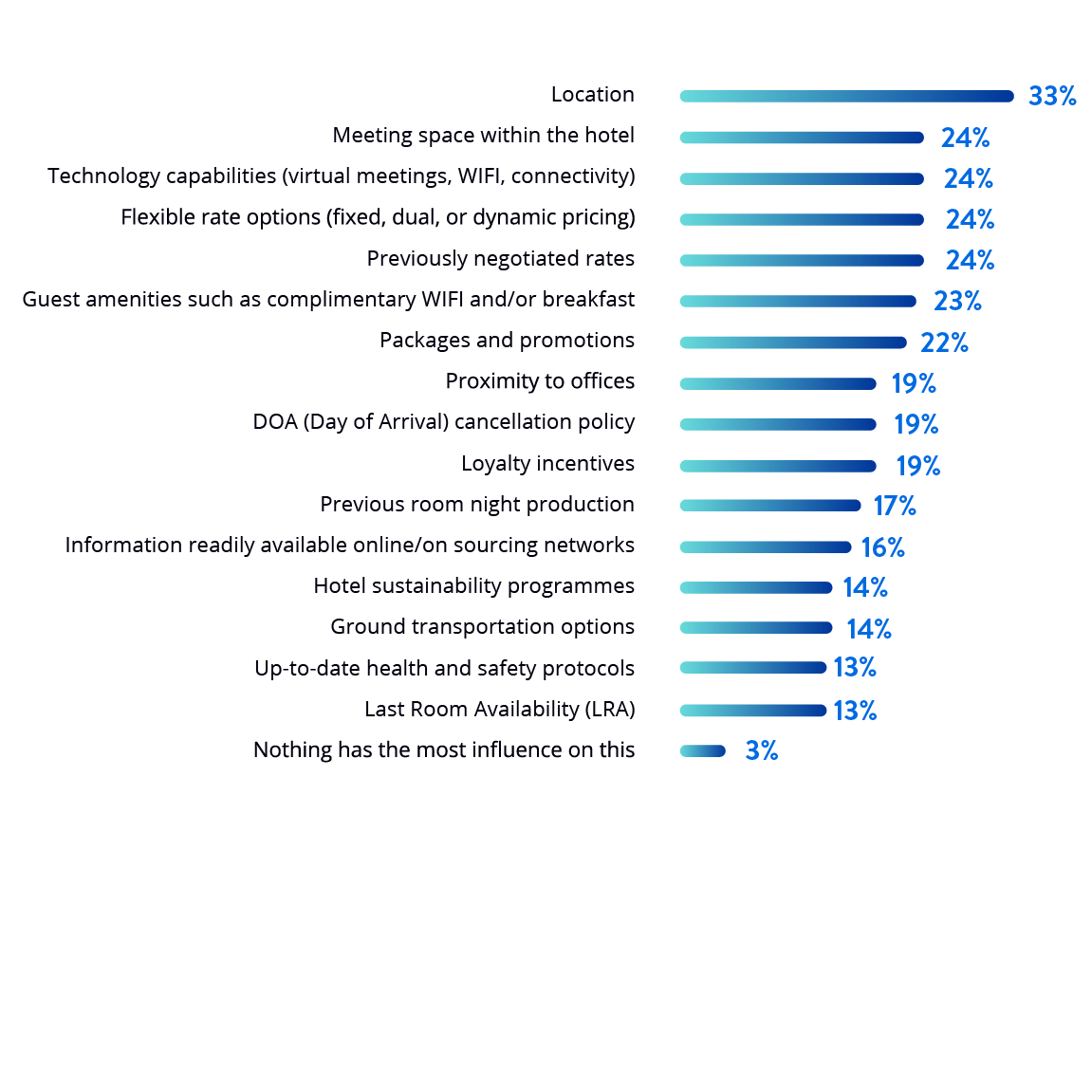

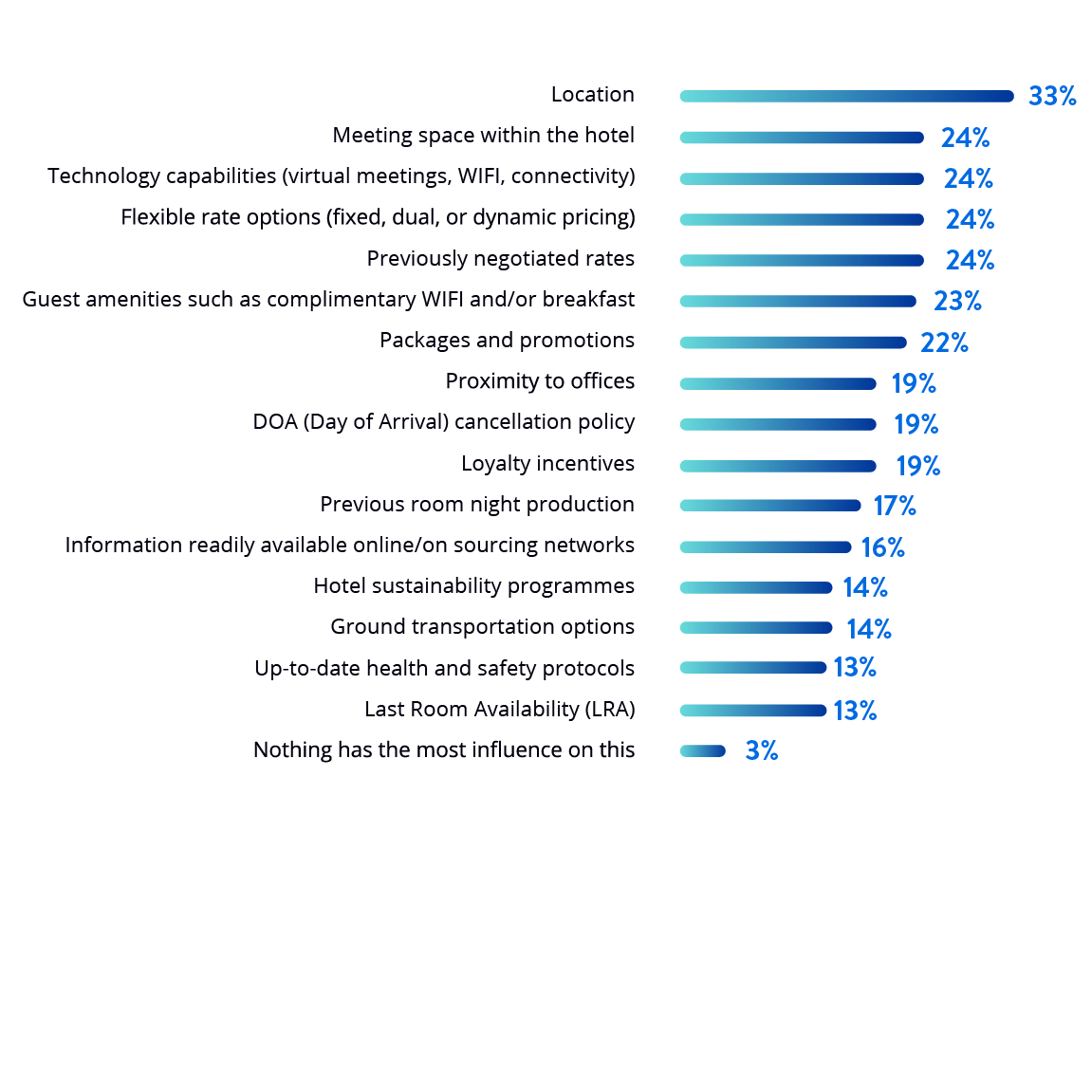

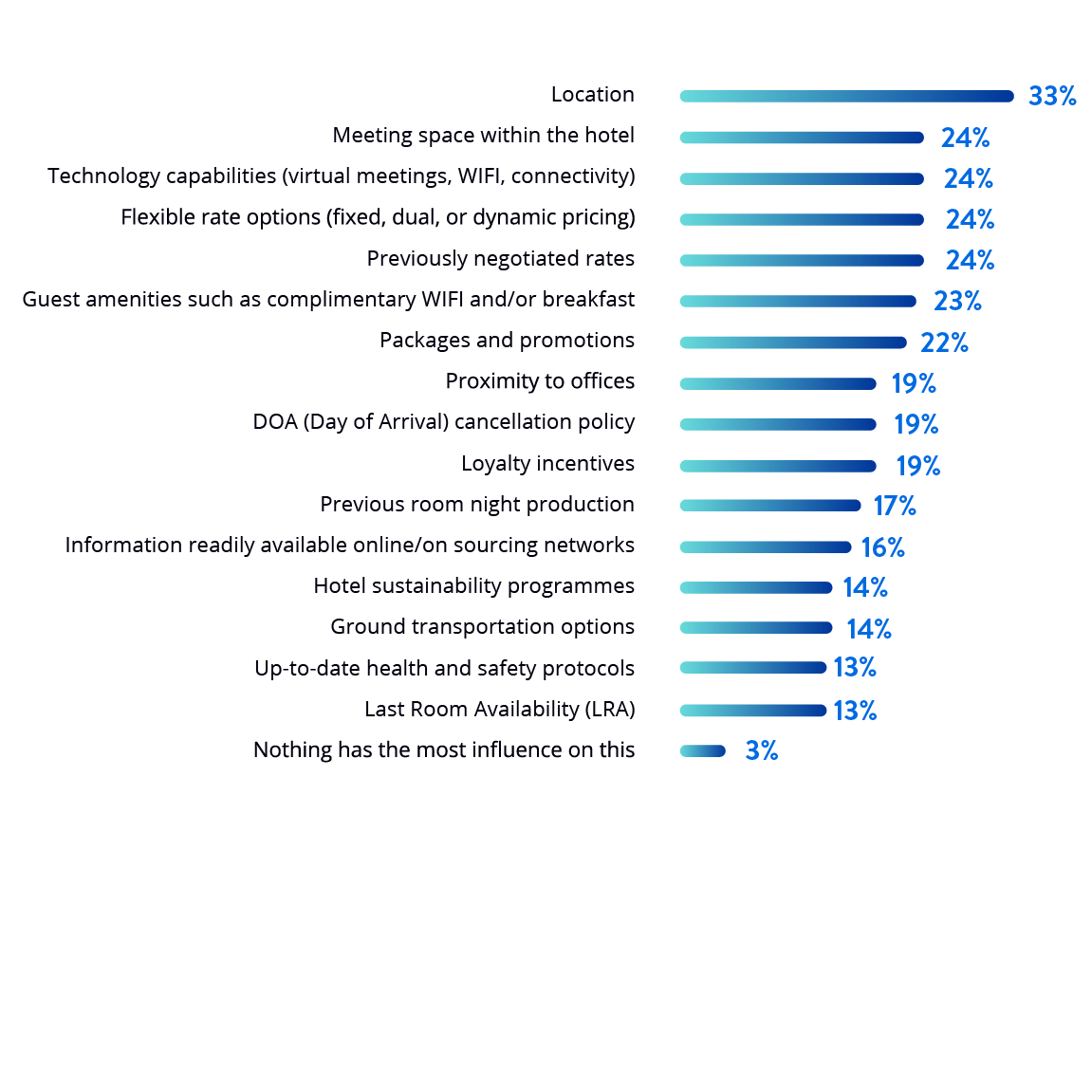

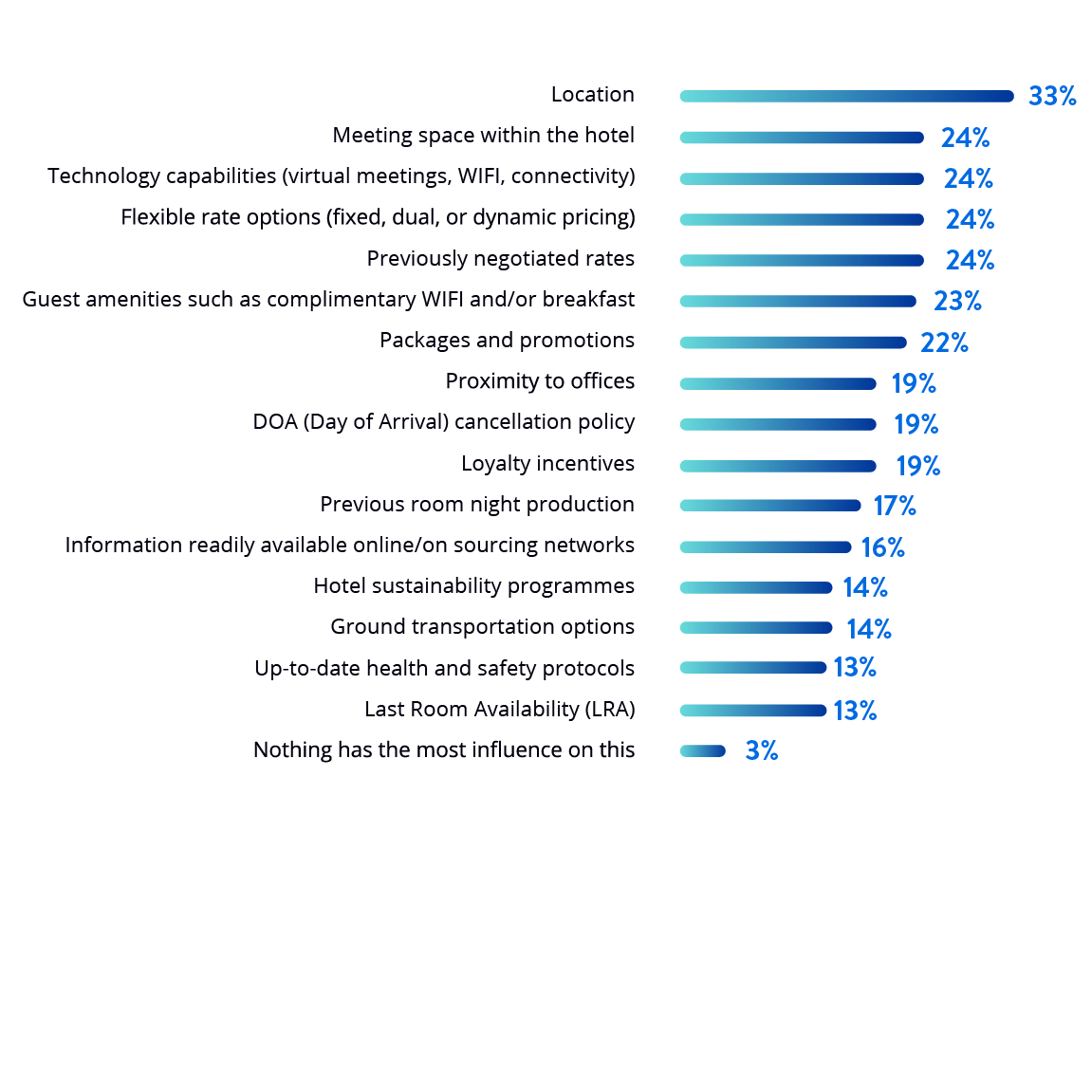

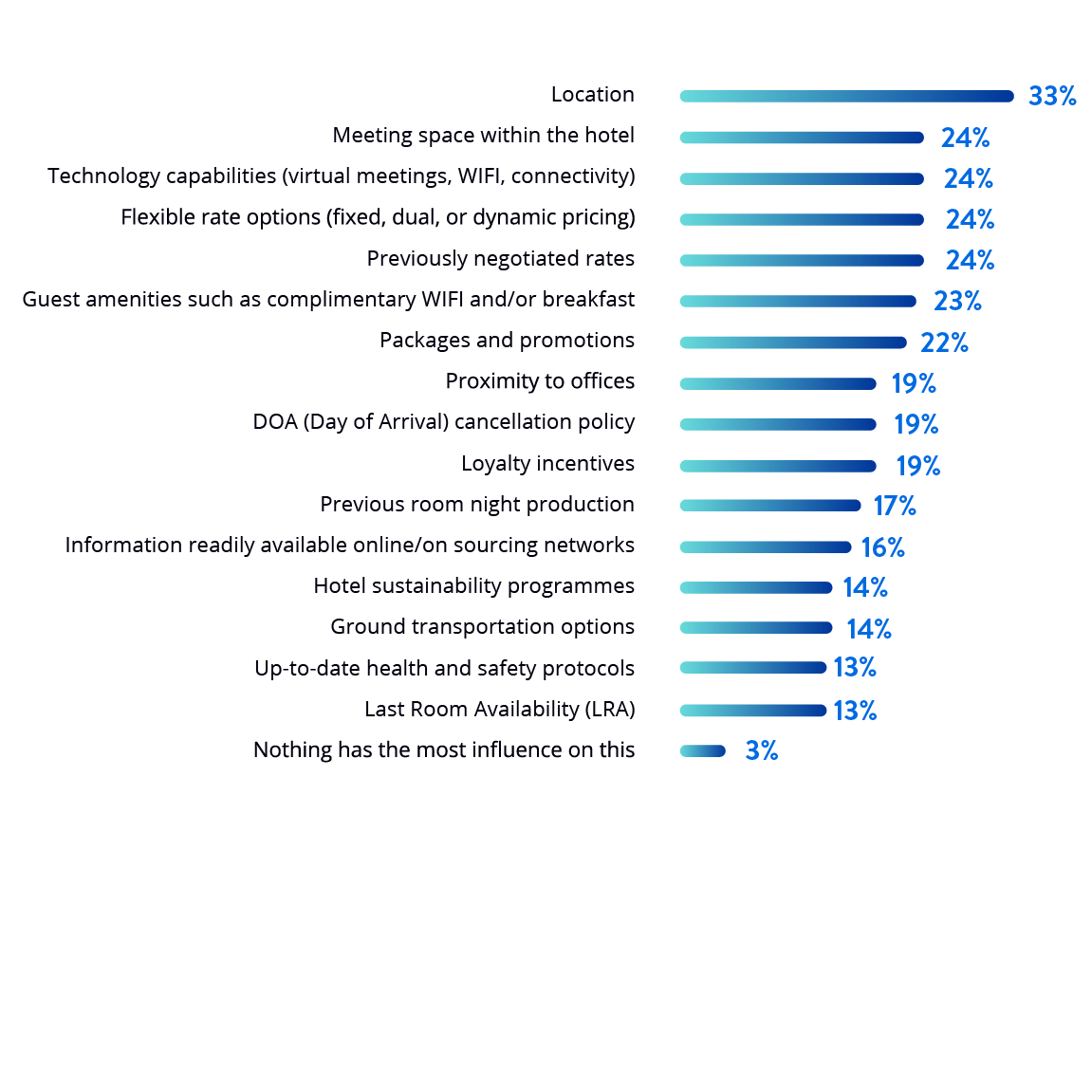

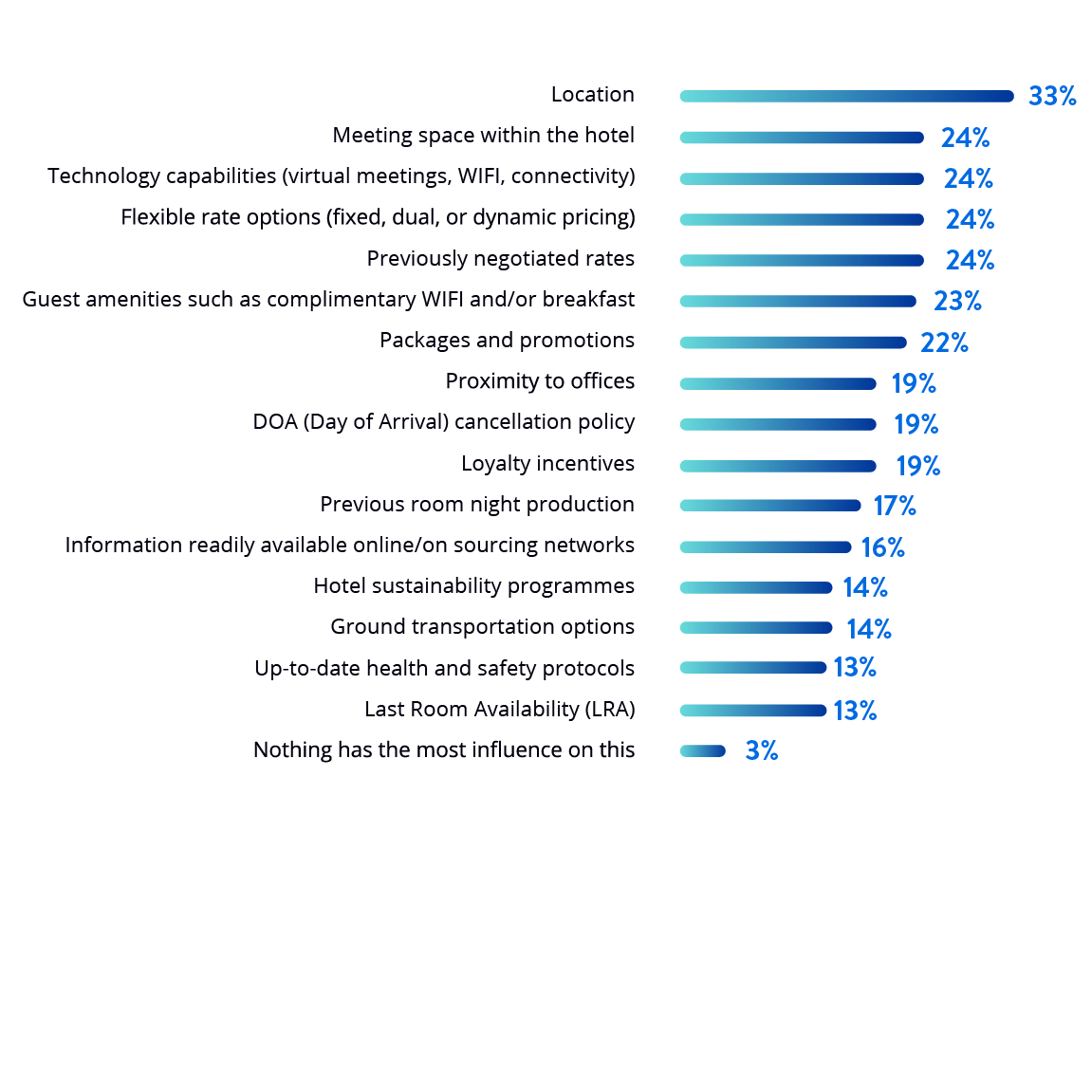

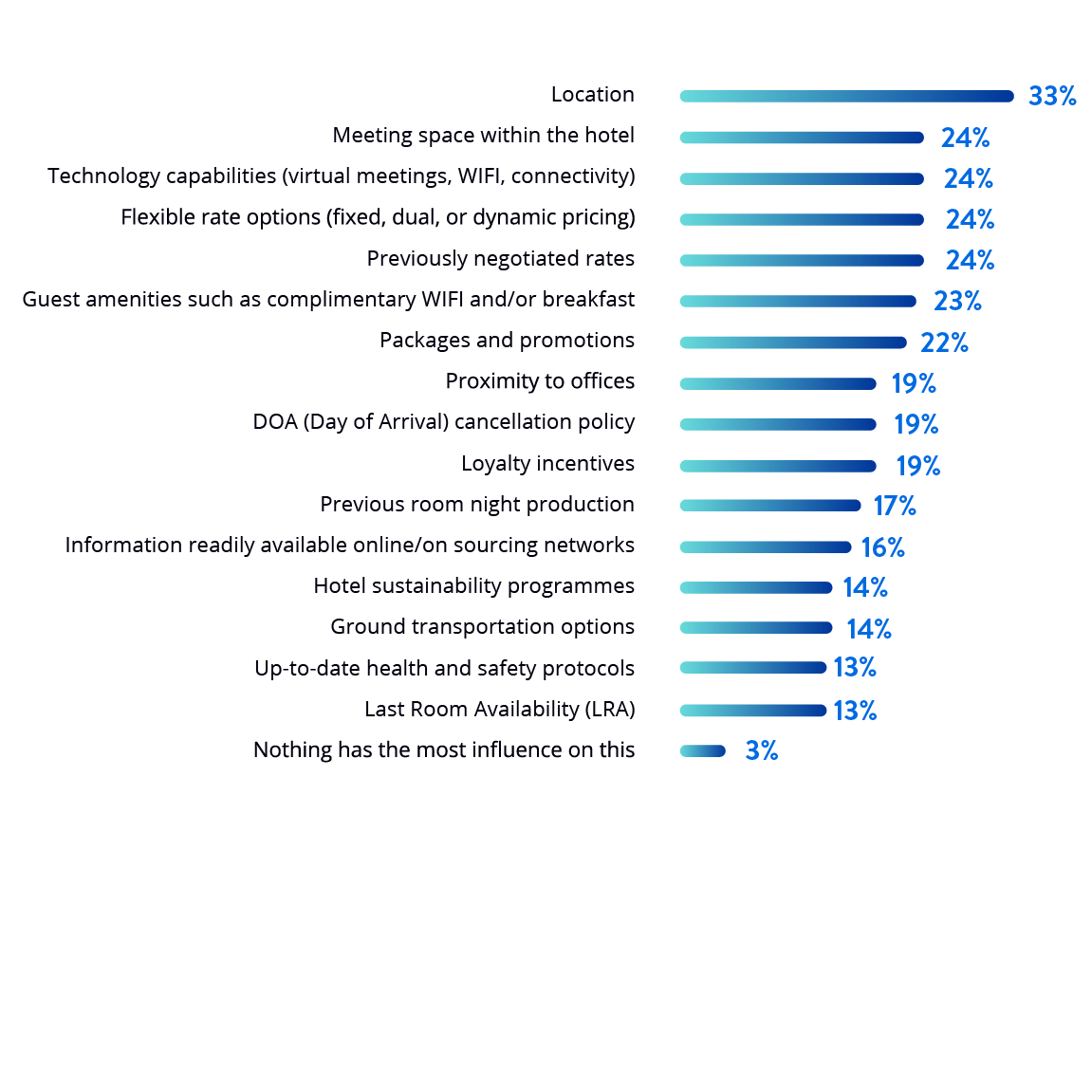

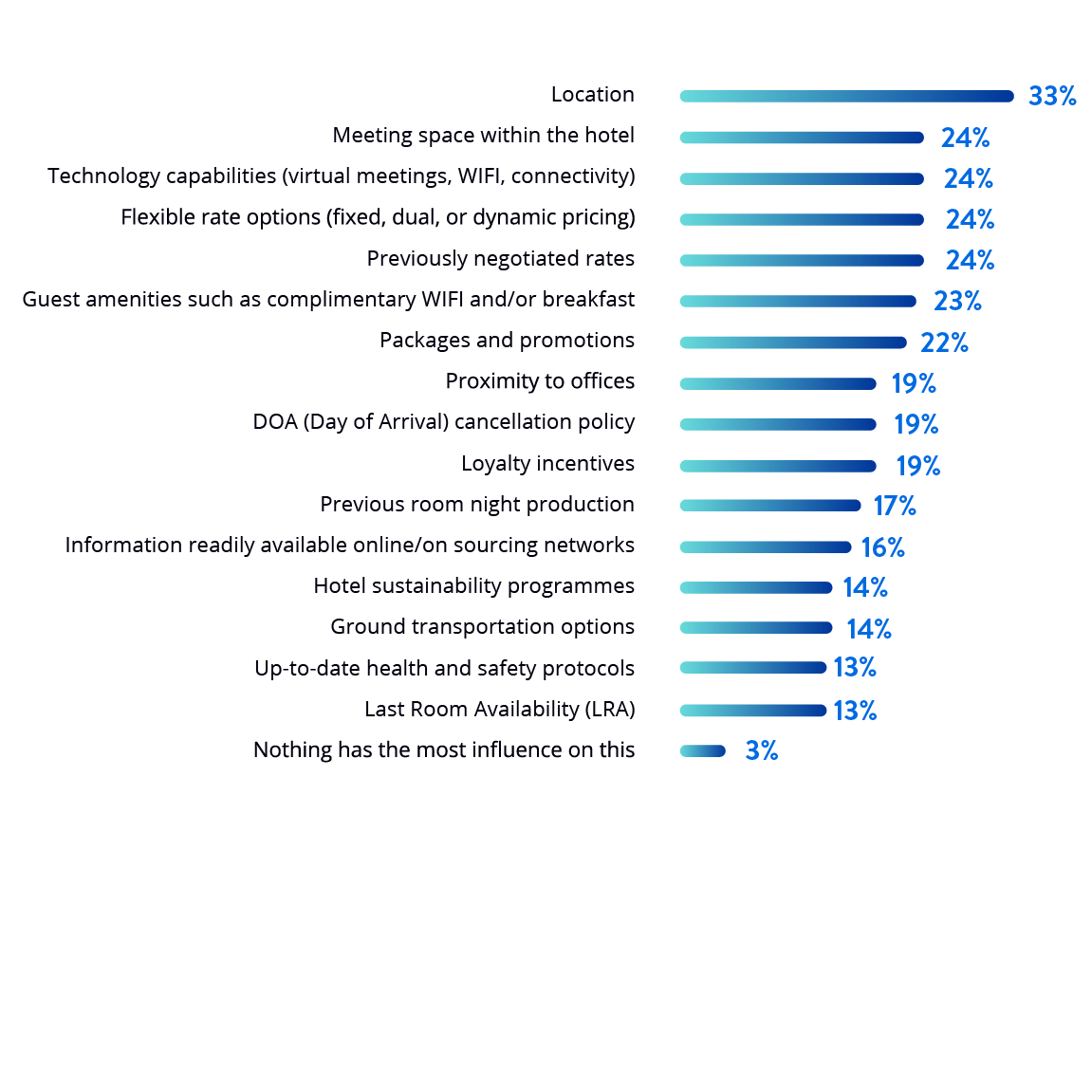

33%

Location

33% of the travel managers are prioritising proximity and accessibility, the geographical location playing a major role in their decision-making process for submitting an RFP.

24%

Meeting space within the hotel

Finding suitable meeting facilities within the hotel is vital for travel managers with 24% of them considering it as a crucial factor in their decision

24%

Technology capabilities (virtual meetings, WIFI, connectivity)

24% of travel managers are considering the availability of fixed, dual, or dynamic pricing options as important criteria for submitting an RFP.

24%

Flexible rate options (fixed, dual, or dynamic pricing)

Advanced technological capabilities and seamless connectivity such as reliable wi-fi, and state-of-the-art AV capabilities are a preference for 24% of the travel managers.

19%

Other factors

Travel managers in Europe are also in preference of some additional factors such as loyalty incentives, proximity to offices, and hotel sustainability programmes.

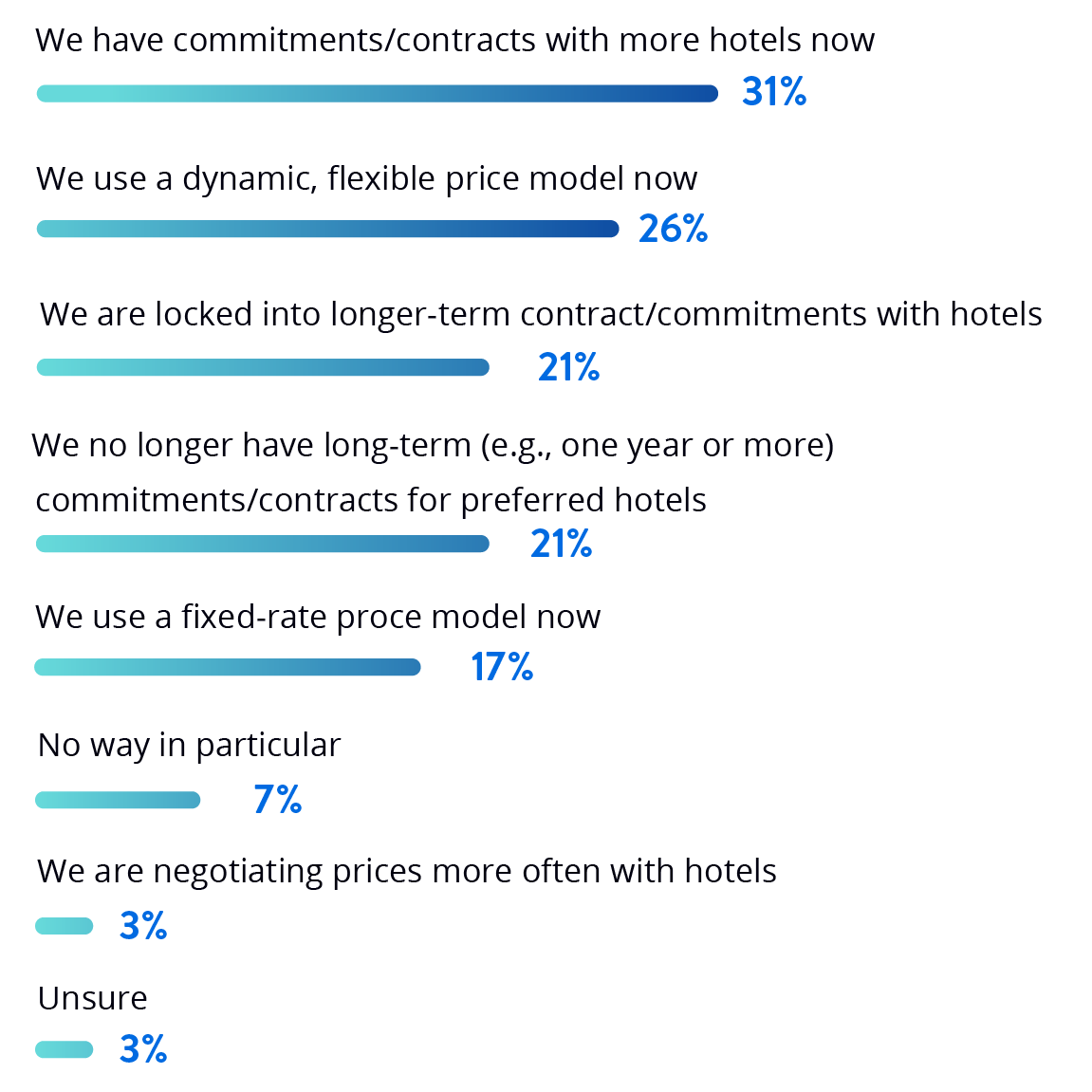

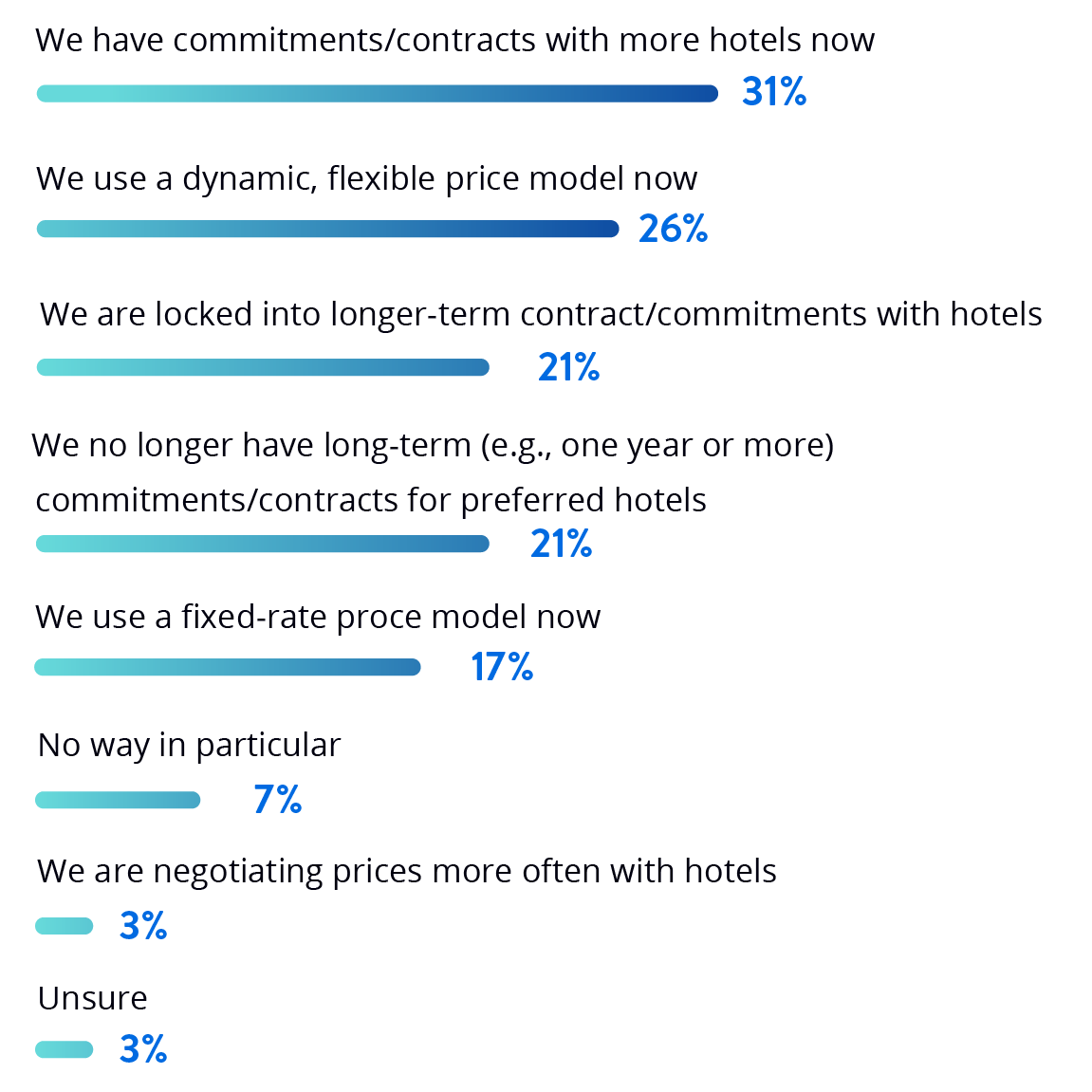

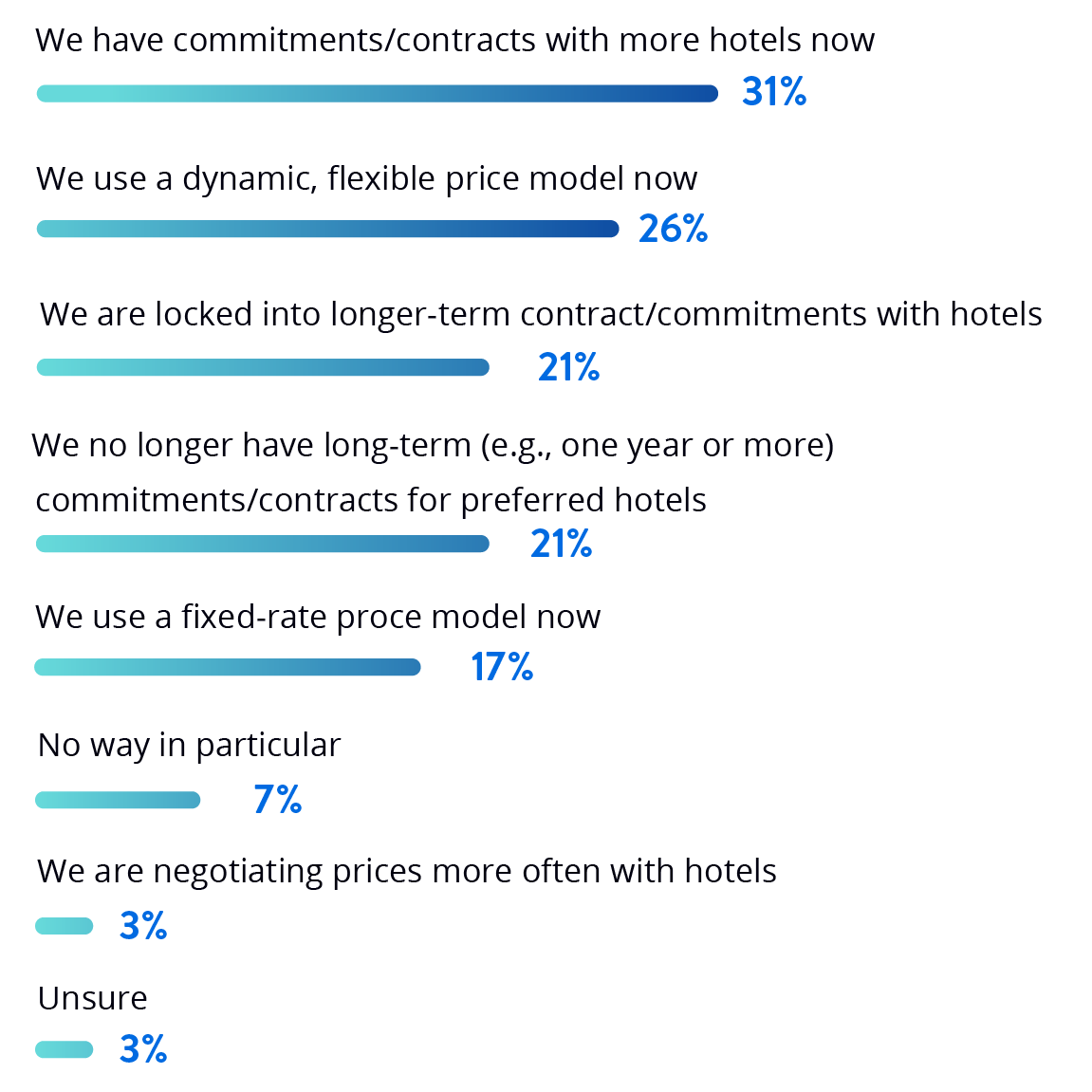

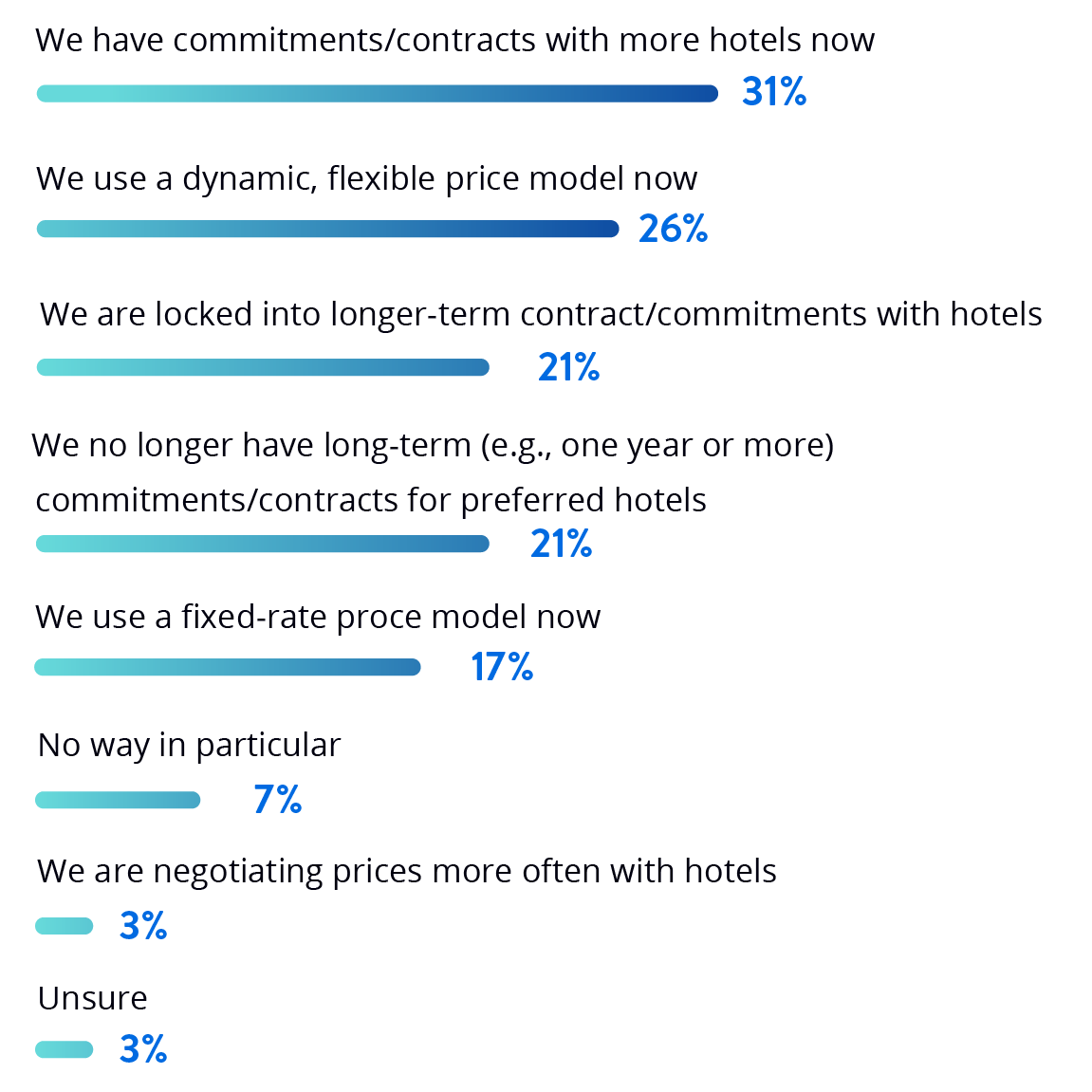

31%

Commitments/contracts with more hotels

31% of travel managers have expanded their network of negotiated hotels and established partnerships with a broad range of properties.

26%

More dynamic/flexible price models

26% of the travel managers have observed a shift towards dynamic price models in their negotiations.

17%

Fixed-rate price models

A little to no-change in negotiations was experienced by 17% of the respondents.

3%

Unsure

3% of the respondents are unsure or do not have enough information to determine how negotiations with hotels has changed in the last five years.

34%

Hybrid/remote work options

34% of the travel managers’ business travel priorities are being shaped by the growing trend of hybrid or remote work.

32%

Increased emphasis on sustainability

With a greater focus on sustainability, 32% of the travel managers are seeking eco-friendly accommodations, transportation and practices.

29%

Continued frequency of virtual meetings

29% of the respondents recognise the efficiency and convenience of virtual meetings and are prioritising it over in-person travel

23%

Increased focus on bleisure

Blending business with leisure activities seems like a hit among 23% of the clients.